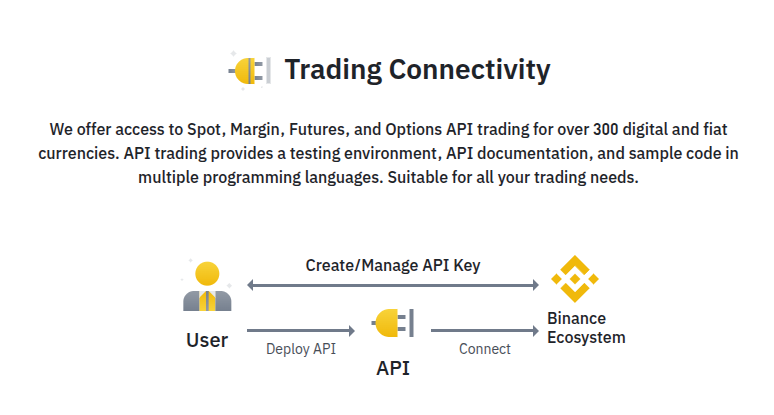

Binance, one of the world’s largest crypto exchanges, offers a suite of powerful APIs that allow developers and traders to build fast, scalable systems that interact directly with the exchange. This is an overview of the Binance API ecosystem.

Understanding the Binance API Ecosystem

Binance offers a broad array of APIs, each designed to give programmatic access to different parts of the exchange. Whether you’re building simple portfolio tools or advanced algorithmic systems, understanding the structure of these APIs is foundational.

Spot Trading API

The Spot API is the most commonly used interface for crypto trading. It allows you to access market data programmatically, place buy/sell orders, and manage your account. You can retrieve real-time prices, historical candlestick data, and market depth snapshots. For developers building bots, dashboards, or analytics tools, the Spot API is typically the starting point.

Margin Trading API

This API is designed for trading with borrowed capital. It provides endpoints to check margin levels, request loans, repay borrowed funds, and trade on leverage. Margin trading introduces additional risk and complexity, so careful error handling and risk monitoring are essential.

Futures APIs

Binance offers two futures APIs: USDⓈ-M Futures (settled in USDT) and COIN-M Futures (settled in crypto). Both provide comprehensive tools for derivatives trading, including live position tracking, leverage adjustments, funding rates, and mark prices. These APIs are ideal for quantitative and high-frequency strategies.

Options API

This API provides access to Binance’s European-style vanilla options. You can fetch contract details, submit orders, and monitor your open positions. Options strategies require advanced risk modeling and latency-aware execution.

Algo Orders API

This API allows developers to implement sophisticated execution strategies like TWAP and POV. It’s perfect for institutions or large traders looking to minimize market impact during high-volume trades.

REST vs WebSocket APIs

REST API

Best for executing discrete commands:

-

Place or cancel orders

-

Fetch account balance

-

Get historical data

WebSocket API

Best for continuous streaming:

-

Live market prices and depth

-

Trade confirmations

-

Balance and order updates

A hybrid approach is typical: REST handles control and setup, while WebSocket ensures timely reactions to market events.

Technical Considerations

Rate Limits

Binance enforces request quotas. Exceeding them will result in bans or throttling. To avoid issues:

-

Use Binance-provided headers to monitor usage

-

Implement exponential backoff

-

Prefer batch endpoints

Error Handling

WebSocket streams can disconnect without warning. Implement auto-reconnect logic, and always validate subscriptions.

Security

Protect your API keys:

-

Use environment variables

-

Enable IP whitelisting

-

Use read-only keys for testing

Best Practices for API Development

-

Use the Binance testnet before going live.

-

Log every API interaction for traceability.

-

Isolate trading logic from infrastructure code.

-

Add fail-safes like position limits and kill switches.

-

Monitor your bots with uptime checks and alerting tools.

Who Uses Binance API?

-

Quantitative Traders: Deploying statistical strategies that rely on fast execution.

-

Fintech Startups: Powering investment apps, dashboards, and analytics tools.

-

Crypto Hedge Funds: Automating position and risk management across complex portfolios.

-

Market Makers: Adjusting liquidity positions dynamically with low-latency APIs.

Binance API development opens the door to advanced, automated, and highly customized trading systems. Whether you’re building a trading bot, managing thousands of positions, or creating a crypto dashboard, the tools are powerful—but demand precision.

Understanding the distinction between REST and WebSocket, mastering rate limits, and following security best practices will go a long way in making your systems reliable and future-proof.

Related Blog Posts

Resources