Why We Built AlgoEdge

Manual trading in crypto markets is inefficient, especially when managing multiple trading pairs, timeframes, and indicators. To solve this challenge, we developed AlgoEdge, an advanced trading analytics platform that provides traders with a significant edge.

At the heart of AlgoEdge is EdgeCore, the high-performance trading engine that powers trade execution, backtesting, and real-time data processing. This powerful backend ensures seamless automation, ultra-low latency trading, and scalable strategy deployment.

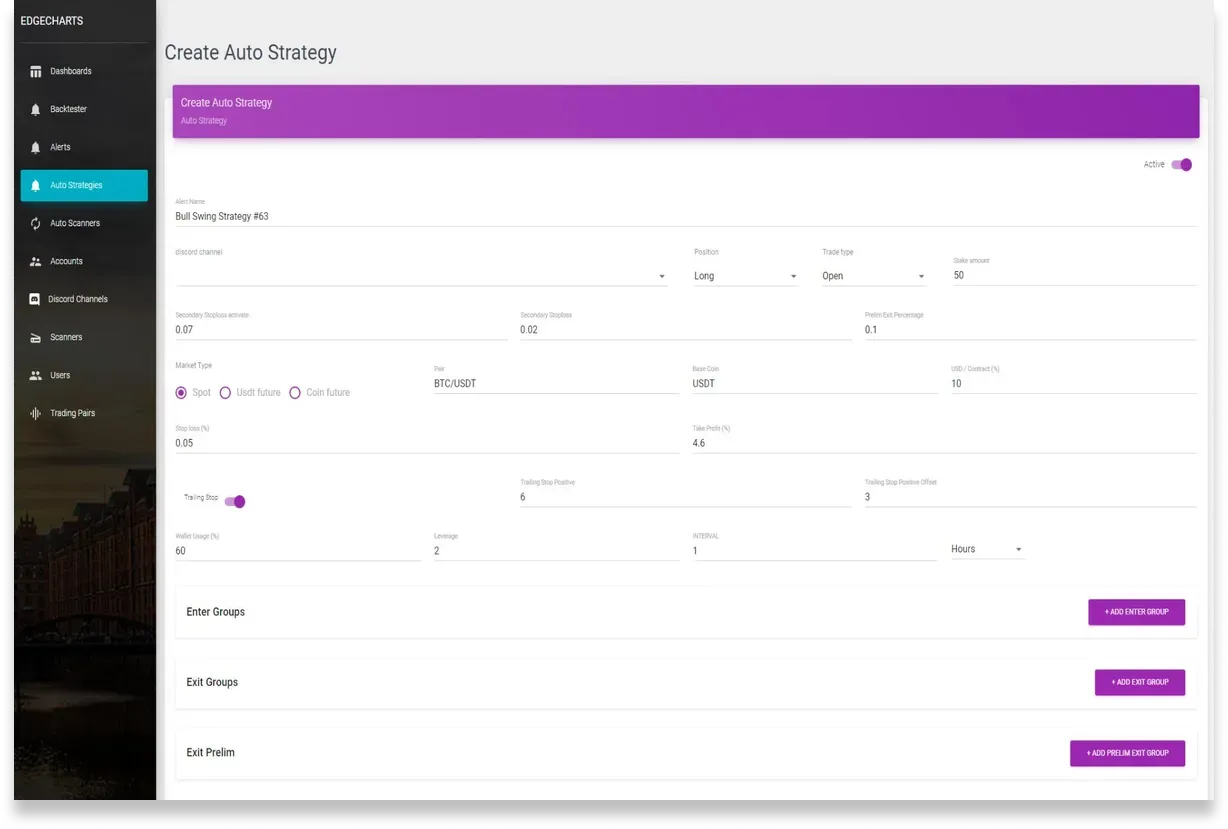

AlgoEdge enables rapid deployment of novel trading strategies by leveraging both historical and real-time data, integrating seamlessly with analytics and alerting tools. Users can backtest and optimize strategies before going live, execute trades automatically with robust risk management, and even utilize a Dry Run Mode to test strategies in real market conditions without placing actual trades.

Core System Architecture

AlgoEdge is built as a modular system, ensuring efficiency and scalability. EdgeCore serves as its computational backbone, providing the speed and reliability required for advanced algorithmic trading.

At its core, the system comprises various data processing services that handle historical and live OHLCV data alongside high-frequency tick data. EdgeCore processes market data in real-time, ensuring that strategies execute precisely when conditions align.

The trading module, powered by EdgeCore, manages order execution, strategy validation, and risk management. Meanwhile, the backtesting service provides simulated trading on historical data, allowing traders to refine strategies with high precision. To enhance user experience and accessibility, AlgoEdge offers custom APIs for communication between services and integrates seamlessly with Telegram and Discord bots for trade execution and real-time alerts.

Key API Integrations

AlgoEdge integrates with multiple APIs to ensure optimal performance, real-time execution, and market insights. EdgeCore processes this data efficiently to power the execution layer.

Binance Exchange API

The Binance API is crucial for accessing market data, managing accounts, and executing trades efficiently.

We use it to fetch historical OHLCV data for backtesting, real-time tickers, leverage settings, and funding rates. WebSocket streams provide 1-minute OHLCV updates, ensuring precise market insights.

On the trading side, AlgoEdge leverages Binance’s API for executing market and limit orders, implementing stop-loss and take-profit measures, dynamically adjusting leverage for futures trading, and monitoring active positions.

Traders can toggle between Dry Run Mode for simulated trading and Live Mode for real execution. Binance’s low-latency WebSocket, deep liquidity, and advanced order types make it a preferred choice for serious traders.

Hyperliquid API

Designed for high-frequency trading, Hyperliquid’s API allows AlgoEdge to access historical OHLCV and trade data for backtesting while continuously monitoring real-time price changes.

Its low-latency execution ensures seamless order placement with minimal slippage. EdgeCore processes Hyperliquid data in real-time, making it ideal for high-frequency trading and dynamic strategy adjustments.

CCXT: Unified Crypto API Aggregator

CCXT provides a single interface for connecting with multiple exchanges, allowing traders to switch seamlessly between platforms.

AlgoEdge uses CCXT to standardize order execution, fetch OHLCV data, access order books, and analyze trade history across multiple exchanges. With support for over 100 exchanges, CCXT eliminates the need for complex, exchange-specific integrations, accelerating deployment for new trading venues.

CoinGecko & CoinMarketCap APIs

To provide real-time token price tracking and fiat conversion, AlgoEdge integrates CoinGecko and CoinMarketCap APIs.

These sources allow traders to retrieve token market capitalization and rankings, convert open positions to fiat, and monitor price movements across thousands of cryptocurrencies. CoinGecko is particularly favored for its comprehensive altcoin coverage and reliable fiat conversion services.

Telegram Bot API

AlgoEdge integrates Telegram’s API to facilitate bot-based trading control and alerts.

Through Telegram, traders can manage trading bots, start and stop strategies, exit positions manually, and receive real-time trade updates and performance summaries. This mobile-friendly integration ensures fast, secure, and private trading interactions on the go.

Discord Webhook API

For traders who prefer community-driven trading updates, AlgoEdge utilizes Discord’s Webhook API to send trade signals, daily performance reports, and system alerts.

Private Discord channels provide a seamless way for users to stay informed about trade entries, exits, and potential system issues in real-time.

Custom API Infrastructure

Beyond third-party integrations, AlgoEdge includes a robust internal API infrastructure tailored for automated trading. EdgeCore handles all backend computations to ensure seamless automation.

AlgoEdge Backend API: Manages CRUD operations for auto-scanners, trading strategies, exchange connections, and user preferences while handling Telegram and Discord notifications.

Backtesting Service API: Simulates historical trades and generates detailed performance reports, including win rate, drawdowns, and Sharpe ratios. EdgeCore processes large-scale datasets at high speeds for accurate backtesting.

Data Processing Services: Handles OHLCV data fetching and resampling alongside high-frequency tick data processing, ensuring accurate market analysis. Redis caching further enhances processing speeds.

Final Thoughts

AlgoEdge is a fully automated trading ecosystem, powered by EdgeCore, its high-performance execution engine. By integrating exchange APIs (Binance, Hyperliquid, CCXT), market data sources (CoinGecko), and communication tools (Telegram, Discord), EdgeCore ensures ultra-fast trade execution, real-time data processing, and risk management.

With EdgeCore at its core, AlgoEdge provides traders with advanced automation, high-speed execution, and intuitive user controls. Whether you're optimizing strategies, executing trades, or monitoring market trends, AlgoEdge delivers unparalleled efficiency and reliability.