What We Did for Munich RE

In our strategic partnership with Munich RE, one of the world’s leading reinsurance companies, we undertook a transformative journey to elevate the company’s analytics and insights landscape. Our objectives were clear – enhance data accuracy, deliver real-time insights, and foster a culture of data-driven decision-making.

Analytics Overhaul

With a focus on Munich RE's unique needs in the reinsurance landscape, we delivered a comprehensive analytics implementation strategy, specifically tailored to enhance the tracking of marketing, sales, and product attribution within the complex and dynamic reinsurance ecosystem.

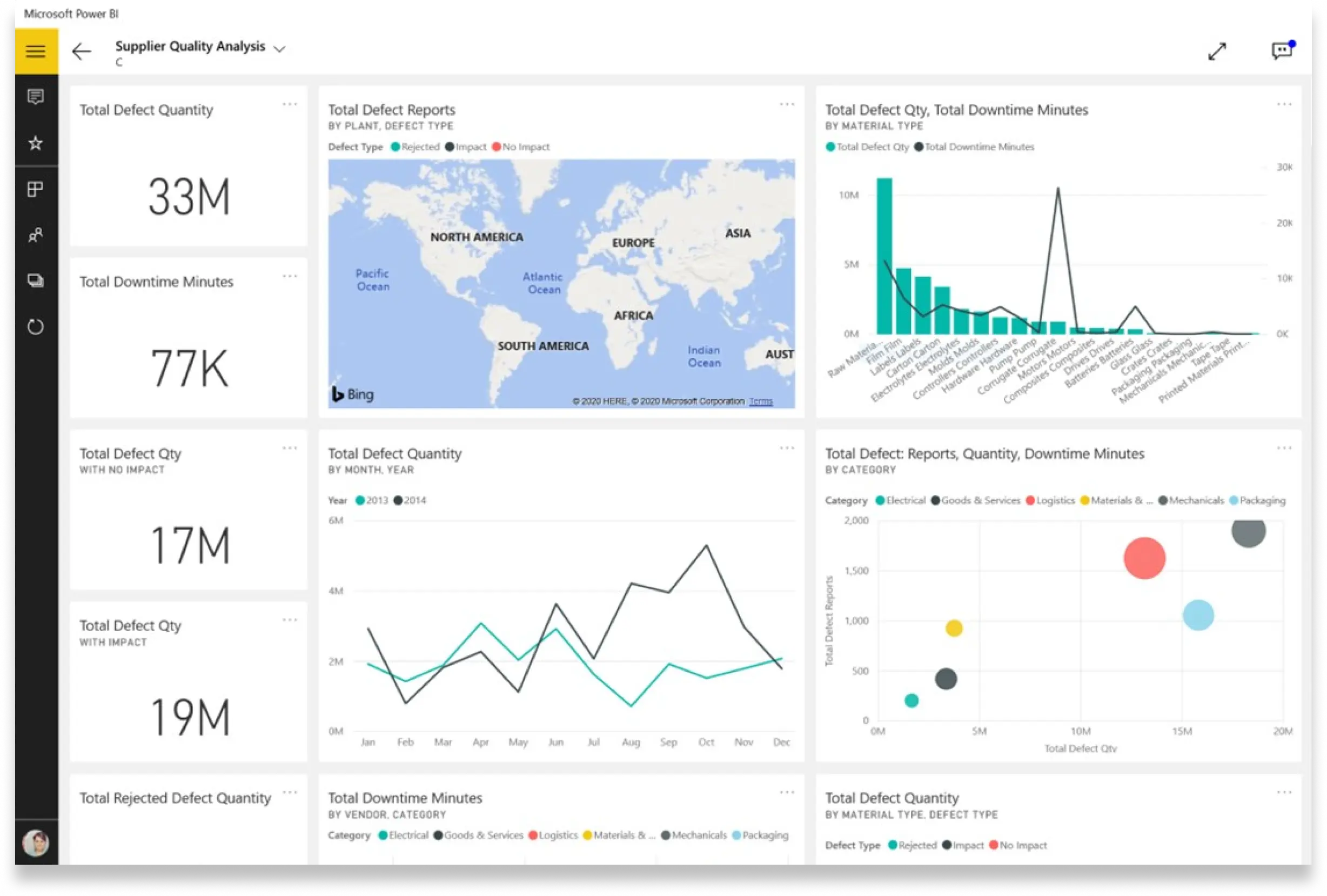

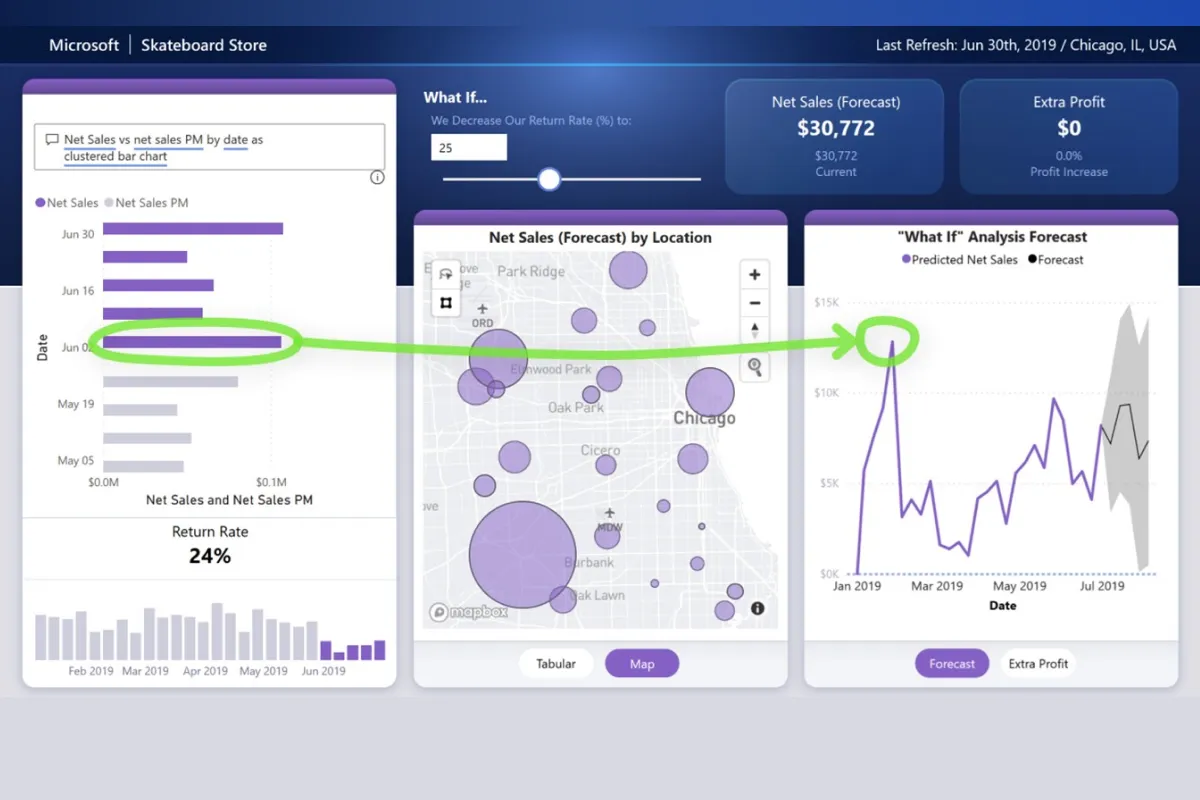

Power BI Integration

Our expertise paved the way for the creation of customized visualizations using Power BI, integrated seamlessly with Munich RE’s CRM systems and Google Analytics. This initiative was instrumental in offering real-time, actionable insights, catering to the nuanced demands of the reinsurance sector.

Data Optimization

Utilizing advanced SQL queries and scripts, we refined massive and complex datasets, ensuring the delivery of precise and accurate data to Munich RE’s in-house visualization tools.

Impact on Munich RE

The bespoke analytics and visualization solutions we delivered had a tangible and significant impact, streamlining Munich RE’s decision-making processes and enhancing strategic agility.

Enhanced Decision-making

Our solutions equipped Munich RE's professionals with real-time insights, leading to improved efficiency in underwriting, risk assessment, and client engagement, thereby optimizing the reinsurance value chain.

Improved Data Accuracy

The integrity of data was bolstered, leading to enriched insights into risk patterns, claims, and customer behaviors. This precision facilitated the development of tailored reinsurance products and services, enhancing Munich RE’s competitive edge.

Collaborative Synergy

Teams across Munich RE, from actuaries to client managers, accessed and collaborated through enriched data visualizations, fostering a holistic approach to risk management and innovative reinsurance solutions.