Precision Equals Profit

Hire top-notch Hyperliquid API developers to make it real without compromise.

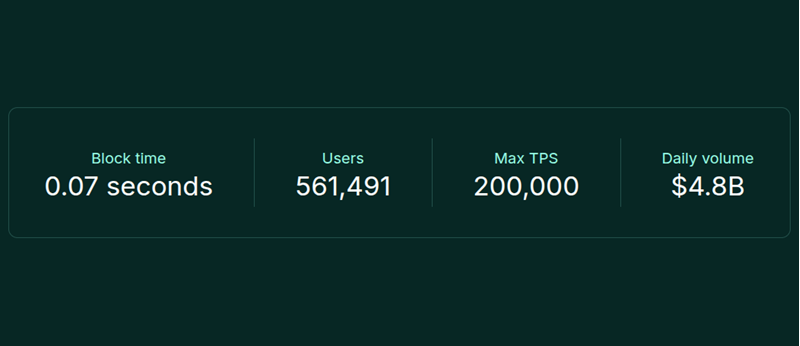

Hyperliquid is not just another chain. It’s an ultra-fast L1 purpose-built for real-time trading, seamless vaults, and a new on-chain experience. No rollup delays. No shared EVM baggage. Just pure performance.

If you're here, you've already made your decision.

You're building on Hyperliquid. Now it's time to build the right way.

Execute Your Vision

You’ve got the vision. A next-gen vault, an algo trading bot, or a market data tool tapping into real-time depth and price feeds.

But like any high-performance system, Hyperliquid doesn’t hand you simplicity.

If you’ve spent time in the docs, you already know:

-

WebSocket payloads are lean but sparse.

-

Nonces, signatures, and API wallets take finesse.

-

HIP-1 and HIP-2 asset deployment requires precision.

-

HyperEVM and API logic don’t always speak the same language.

And you’re not here to lose time stitching things together. You’re here to ship.

Why Deploi for Hyperliquid API Development

Success on Hyperliquid isn’t just about knowing what’s possible. It’s about making it real with precision and expert execution.

You don’t want freelancers who are still “exploring” the platform. You need top-notch engineers who’ve lived in the protocol. Developers who’ve already debugged the nuances. Builders who treat latency, throughput, and uptime as non-negotiables.

You also deserve to collaborate with a team that shares the same values as you do, such as integrity, work ethic, kindness, and empathy.

That’s where we come in.

What We’ve Engineered

At Deploi, we didn’t start by offering Hyperliquid API development to clients. We began by building for ourselves.

Our infrastructure results from years of iteration — tested internally across thousands of trades, real-time market conditions, and custom automation layers. Everything we’ve built reflects a commitment to speed, reliability, and precision.

Here’s a look at what we’ve engineered behind the scenes:

AlgoEdge

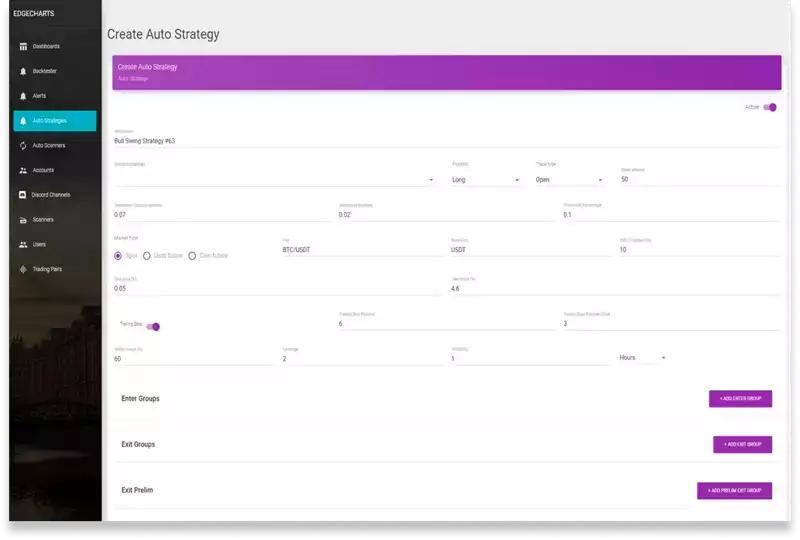

Our in-house algorithmic trading platform for real-time execution, strategy modeling, and market scanning. Built to handle streaming OHLCV data, backtest strategies on historical and live feeds, and power advanced trading logic through over 50 proprietary indicators.

With a clean interface and CCXT-based exchange integration, AlgoEdge gives traders the control to build, test, and deploy with confidence.

EdgeCore

A high-performance execution engine designed for ultra-low latency trading. EdgeCore processes millions of data points per second and is the backbone for our automated execution systems.

Truso

A real-time signal delivery platform was developed to push timely, quant-backed trade signals to users across multiple asset classes. It has a clean interface, instant delivery, and built-in alert logic.

Hyperliquid High Frequency Bot (In Progress)

We’re developing a dedicated high-frequency trading bot explicitly designed for Hyperliquid’s ultra-fast Layer 1.

This system integrates directly with the Info and Exchange APIs, leverages WebSockets for live execution, and includes adaptive risk logic for vault-ready strategy deployment. It’s designed for speed but built for scale.

Custom Bots for Hyperliquid Execution

We’ve built custom bots that tap into Hyperliquid’s API for automated execution — placing and managing orders via WebSocket, adapting leverage based on position size, and automating stop loss and take profit placement in real-time.

Smart Arbitrage Systems

Latency matters in arbitrage. Our system detects market price mismatches, routes orders through optimized paths, and executes before spreads vanish. Rate limit optimization and slippage control are built in from the ground up.

Portfolio Controls and Risk Logic

We’ve engineered tools to automate risk exposure, monitor leverage, and issue custom alerts via Telegram or Discord — ensuring no strategy runs unchecked, even at scale.

Custom Alerting System

We built a flexible alerting engine that allows users to define highly customized alerts across any combination of market conditions.

Scanner results, strategy conditions, or webhook inputs from third-party platforms like TradingView can trigger these alerts.

Alerts are instantly delivered through multiple channels via progressive web apps, including Telegram, Discord, and browser push notifications. This system is deeply integrated with our internal logic, allowing it to trigger on entries, exits, or in-trade management events.

Real-time asset Scanners

Our real-time scanners are designed to quickly detect specific conditions across thousands of assets — such as when an asset enters a specific RSI range, breaches volatility thresholds, or meets trend alignment across multiple timeframes.

What makes this system powerful is its modularity. We can build and deploy dozens of custom scanners in minutes, combine them into complex logic chains, and run them manually or as automated background tasks. These auto scanners feed directly into our alerting and strategy engines.

Algorithmic Strategy Engine

Scanners serve as the foundational building blocks for our algorithmic strategies. We can create, test, and deploy new strategies in minutes by selecting combinations of scanners as entry conditions, management logic, and exit criteria.

Our strategy builder supports complex features like dynamic stop-loss logic, trailing exits, and conditional scaling. Strategies can run in simulation, backtesting, or live trading modes — making it easy to move from idea to production with minimal friction.

Backtesting Infrastructure

At the core of our development loop is a custom-built backtesting engine capable of handling billions of data points across thousands of assets. We can simulate complex strategies over multi-year historical datasets, generating performance reports that include millions of individual trades.

This allows us to test the robustness of any strategy under different market regimes quickly and confidently.

Performance Visuals

We built internal charting tools to interpret results that overlay trade entries and exits on historical price charts. These visuals are available for every backtest and live-traded strategy, making it easy to spot false positives, execution delays, or missed opportunities.

This isn’t just about looking back — it’s about improving strategy design with every iteration.

Dynamic Real-Time Heatmaps

This tool allows us to visualize asset-level confluence in real time. Heatmaps dynamically compare every asset in scope against defined scanner conditions and strategy logic, surfacing the most aligned opportunities at any moment.

It’s like scanning an entire market in a single glance.

Historical Heatmaps

Similar to our real-time version, these historical heatmaps allow us to track how often specific confluences occurred in the past — broken down by asset and timeframe.

This adds a valuable dimension to strategy analysis: whether something works and how consistently it has worked.

Proprietary Technical Analysis Indicators

We developed our own set of proprietary technical indicators built on original mathematical formulas. This wasn’t just for innovation — it was born out of necessity.

Most of the commonly used indicators in trading today were created decades ago, before modern markets, real-time data, and algorithmic execution became the norm. Our proprietary indicators give us more accurate signals, better alignment with market structure, and a significant edge in backtesting and live deployment.

They are foundational components across our scanners, strategies, and alerting systems.

What to Look for When Hiring Hyperliquid API Developers

When it comes to building on Hyperliquid, not all developers are created equal. This isn’t a plug-and-play API. It’s a high-performance, low-latency system built on a custom Layer 1 chain. Getting it right means hiring people who understand the architecture and the edge cases — not just the docs.

Here’s what to look for when hiring Hyperliquid API developers:

Protocol Level Understanding

Hyperliquid has unique mechanics, from its simplified nonce structure and stateless execution model to how it handles margining, order books, and vault logic. A solid developer doesn’t just write code. They understand how the system works under the hood.

Experience with Real-Time Systems

Hyperliquid’s performance edge comes from its speed. Your developer should be comfortable working with WebSocket streams, real-time data ingestion, and event-driven architecture. They may not be ready for the latency demands if they’ve only worked with REST APIs and batch scripts.

Comfort With Custom Infrastructure

Integrating with Hyperliquid often involves more than just calling endpoints. Developers should be comfortable building supporting systems such as execution engines, alerting logic, smart order routing, and vault triggers. Look for someone who can connect the pieces.

Security and Risk Awareness

Because many builds on Hyperliquid involve financial logic and wallet interactions, developers must be comfortable handling signing flows, managing API keys, and building with operational safety in mind. You want someone who understands edge cases and how to defend against them.

Flexibility and Builder Mindset

Hyperliquid is still evolving. That means your developer needs to be adaptive. You want someone who can move fast, respond to changes, and build modular systems that scale. Bonus points if they’ve already built trading infrastructure or DeFi native tools.

Proven Execution, Not Just Theory

Finally, look at what they’ve built. Have they gone beyond demo scripts? Have they deployed real tools, bots, dashboards, or vaults? Experience in production matters, especially in systems where milliseconds and margins make a difference.

How Much Does It Cost to Hire an Experienced Hyperliquid API Developer

Hyperliquid API development costs vary widely based on developer expertise, project complexity, and your chosen service provider.

Typical Rates for Hyperliquid API Development

Freelancers: $80 - $150 per hour. You’ll find independent developers at lower rates, but many lack real-world experience with trading infrastructure, WebSocket streaming, or the nuances of Hyperliquid’s nonce and wallet system. While budget-friendly, they often require more oversight.

Development Agencies: $150 - $300 per hour. Most agencies charge more — primarily due to overhead — and many aren’t fluent in DeFi-specific architectures. You may end up paying a premium without getting protocol-level expertise.

Deploi: $100 per hour. Whether you need custom integrations with the Info and Exchange endpoints, real-time WebSocket parsing, or cross-chain vault logic, we deliver fast, clean, and tailored solutions built for scale.

Hyperliquid API Overview

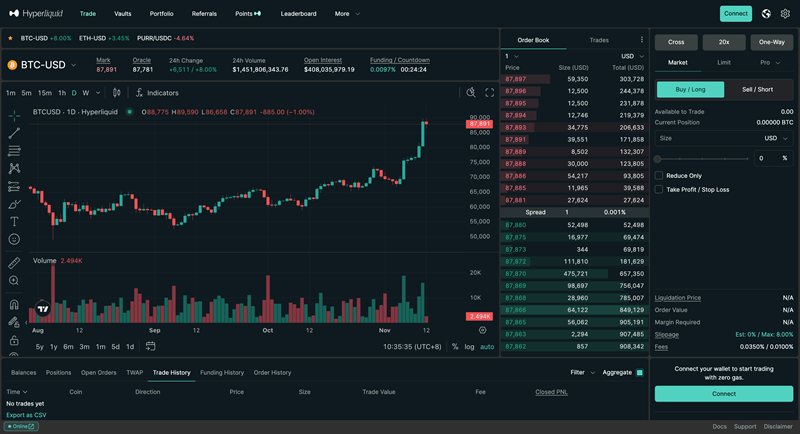

Hyperliquid’s API is purpose-built for speed, transparency, and real-time interaction. It reflects the chain’s core philosophy: On-chain doesn’t have to mean slow.

Unlike traditional EVM-based DeFi protocols, Hyperliquid operates its custom Layer 1 chain optimized for low latency execution. This enables a new standard for trading infrastructure that feels responsive, consistent, and ready for scale.

The API is divided into two primary interfaces: the Info API and the Exchange API.

The Info API allows developers to retrieve comprehensive market data. This includes funding rates, open interest, price indices, tick sizes, lot sizes, and a complete list of available spot and perpetual markets. Most trading systems start here, syncing with live market structure and tracking updates through WebSocket feeds.

The Exchange API places and cancel orders, manages positions, and handles wallet balances. It requires signature authentication and is designed for performance. A streamlined nonce system and stateless execution model support everything from market-making bots to custom vault strategies.

In addition to these core APIs, developers can access WebSocket endpoints for real-time data streaming and JSON-RPC methods for HyperEVM vault interactions and asset deployments.

Whether you're building a strategy dashboard, deploying HIP-1 tokens, or integrating custom logic into Hyperliquid’s execution layer, the API gives you the flexibility and control to make it real.